Insurance Technology Article:

The phrase Big Data seems to have taken the technology world by storm this year. A year ago, many insurance company’s IT Directors, even CIOs were not aware of Hadoop; now it is becoming an industry standard at many carriers. But in reality big data is not new to the insurance industry. It continues a trend that probably started back in the 1970’s with the invention of policy administration solutions and other IT systems. What has changed in recent years is the velocity of data flow, the volume or size of data generated and the diversity of the data.

The optimistic vision for big data is that organizations will be able to harvest and harness every byte of relevant data and use it to make supremely informed decisions. But is this realistic? This question and more was discussed by leaders from insurance, banking and public policy organizations at the SAS Financial Services Executive Summit earlier this year. According to Aditya Bhasin, Customer Marketing Executive, Bank of America “For us, big data is a way of life. We have somewhere in the order of 65 petabytes of customer data, and yet we use maybe 1 percent of it for analytics”. While Charles Thomas, Market Research & Analytics Executive at USAA, said “Understanding what happened yesterday really, really well is not going to be enough for us to operate in real time tomorrow. At USAA we are moving away from what we call hindsight and moving towards foresight”.

To learn more insights from this discussion download a copy of the conclusion paper “Big Data for the Next Big Idea in Financial Services”.

Today, insurance companies are becoming data intoxicated as they consume more and more data. But the true value of big data lies not just in having it, but in being able to use it for fast, fact-based decisions that lead to real business value. Insurance companies can’t wait days or weeks to look at different what-if scenarios before making a decision. Decisions need to be made in minutes or hours not days or weeks. To address these challenges insurers are turning to SAS High-Performance Analytics.

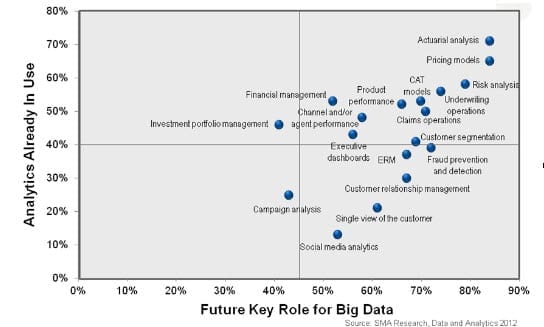

The concept of Big Data and High Performance Analytics was further covered by Strategy Meets Action (SMA) in their recent white paper “What Does Big Data Really Mean for Insurers”. In this paper SMA discussed that there is a paradigm shift underway with leading insurers adopting a “management by analytics” approach to running the business. This shift, fueled by Big Data and High Performance Analytics is enabling insurers to select more profitable business, implement more precise pricing, manage the risk portfolio holistically and improve fraud detection.

Analytics has often been compared to looking for a needle in a haystack. As insurers analyze data to find the nugget of information that will provide them with competitive advantage. With Big Data the haystack now got a LOT bigger, but with High Performance Analytics not only can you find the needle quicker, but know it’s made of gold.

I’m Stuart Rose, Global Insurance Marketing Principal at SAS. For further discussions connect with me on LinkedIn and Twitter.