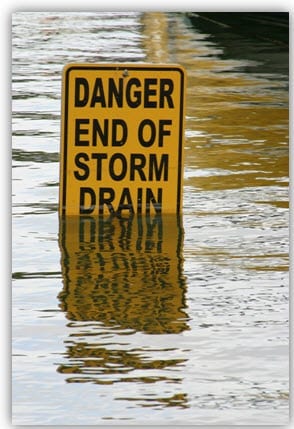

The high season for flooding is from February to the end of April. All depending on temperatures and predictions of record rain fall, there are many areas that are considered high risk by FEMA, the Federal Emergency Management Agency.

The high season for flooding is from February to the end of April. All depending on temperatures and predictions of record rain fall, there are many areas that are considered high risk by FEMA, the Federal Emergency Management Agency.

FEMA is paying special attention to Davison County in South Dakota. On Friday, the agency released a warning: a 98% chance of minor to moderate flooding, with at least a 50% chance of major flooding. This area is home to over 20,000 people and the biggest threat is the rising waters from James River.

The agency is sending representatives out to such high risk areas to provide information and awareness to the residents. Ron Warren, a FEMA representative, advised residents to have a plan and an emergency kit for their family in the event of being stranded.

Along with FEMA, representatives from the National Flood Insurance Program are also visiting America’s hot spots. Both agencies are suggesting flood insurance being the best alternative and are warning consumers not to wait until it’s too late. Making sure people are aware of a mandatory 30 day waiting period that they could be subject to.

They also warn that flood insurance is not just for those in high flood zone areas. That 30 to 40% of flood claims are out of the mapped flood zone areas. Also, citing that people who have insurance will receive more coverage than someone who relies on disaster relief – which is subject to limitations and funds available at the time.

Mortgage companies also regularly require flood insurance for homes that are in high risk areas. If insurance is not proven, forced place coverage can be added at a much higher rate. To find out if you’re at risk contact a local insurance professional for details on rates.