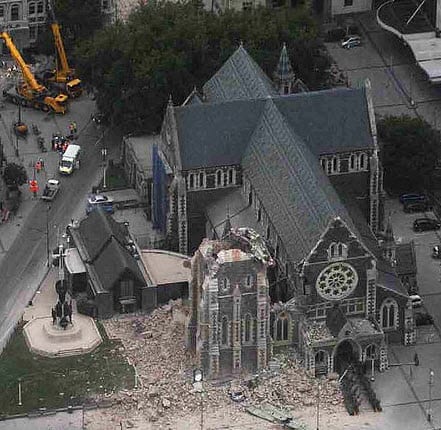

Several months after a destructive earthquake struck New Zealand, the city of Christchurch is still plagued by violent aftershocks. According to Chris Ryan, head of the Insurance Council of New Zealand, the persistent aftershocks bode ill for the nation’s insurers. Ryan is warning citizens to prepare for dramatic changes coming to the insurance industry as many companies begin to see New Zealand as a high-risk nation.

Several months after a destructive earthquake struck New Zealand, the city of Christchurch is still plagued by violent aftershocks. According to Chris Ryan, head of the Insurance Council of New Zealand, the persistent aftershocks bode ill for the nation’s insurers. Ryan is warning citizens to prepare for dramatic changes coming to the insurance industry as many companies begin to see New Zealand as a high-risk nation.

Many of the insurance companies operating in the nation, particularly property insurers have been ramping up rates in an effort to recoup their losses in the wake of the disaster.

Ryan notes that reinsurers have become weary of doing business in the nation because of its new high-risk status. Suzanna Wolton of AA Insurance says that their unease is well founded. Wolton sites reports from several risk modeling firms claiming that there is a 1 in 4 chance of another catastrophe striking Canterbury, the region of New Zealand in which Christchurch is situated.

To do, aftershocks have led to the demolition of more than 100 buildings in the Canterbury region. Insurance claims regarding these building, as well as hundreds of others that have suffered damage, have been pouring in at a steady pace, says Wolton. While insurers handle claims and consider major changes to their operation in the nation, The Earthquake Commission and Insurance Council are heading to New Zealand’s High Court to determine which organization is liable to pay for the damage.