GradGuard™ search tool makes it easy for college parents to protect their students and investment from the risks of college life.

Phoenix, Arizona, May 14, 2019 – Millions of high school graduates have selected the college or university where they are confident they will successfully complete their degree. Unfortunately, only slightly more than half of students who start college will successfully complete their degree. As a result, college students and their families are smart to be ask some essential questions regarding their investment in higher education and take steps to prepare to overcome risks that may disrupt their education.

‘Paying for college is often the second largest investment college families make and it is important to recognize that it is not risk free” said Bob Soza, Chairman of College Parents of America.

John Fees, co-founder of GradGuard™, an authority on college risks that works closely with more than 300 colleges and universities that has protected more than 650,000 college students and families recommends the following smart tips:

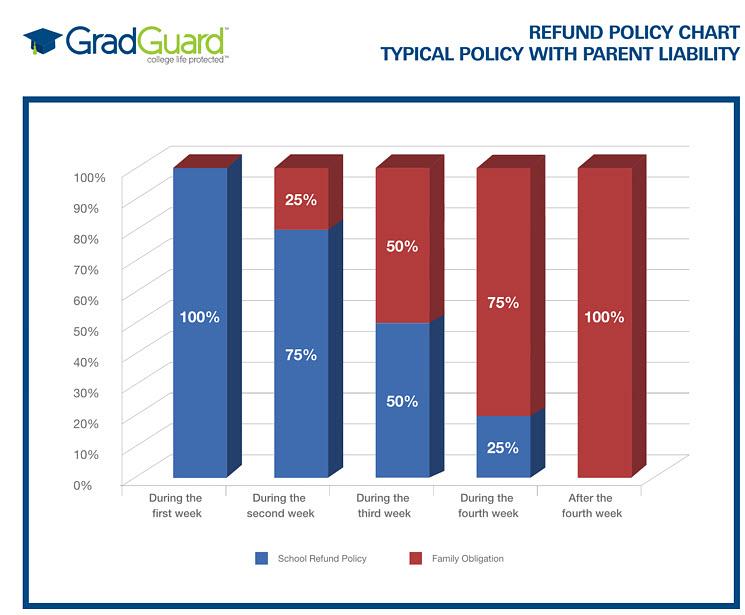

Know Your School Refund Policy: If your student has to withdraw from college due to a serious illness, injury or accident, it is unlikely that you will receive a 100% refund. Only 16% of schools surveyed provide 100% refunds of tuition, and virtually no schools will refund the cost of academic fees, room and board. Tuition insurance can provide a refund, however, when schools do not. If you cannot afford the cost of an extra college semester, then it is essential to purchase tuition insurance coverage prior to the start of classes. The good news is that college families can protect their investment by purchasing tuition insurance starting at $33.75 for $2,500 per term.

Confirm Health Insurance Coverage: Many colleges offer health insurance plans to students and require them to purchase or opt out by showing proof of alternative insurance. According to American College Health Association, about 10 percent of students get their health insurance through their school. A college health insurance plan may make sense for some students. But if you have family health insurance, your college student can remain on a parents’ plan until age 26. Be sure to confirm the requirements to use your student campus health clinic and be sure to not pay twice for coverage.

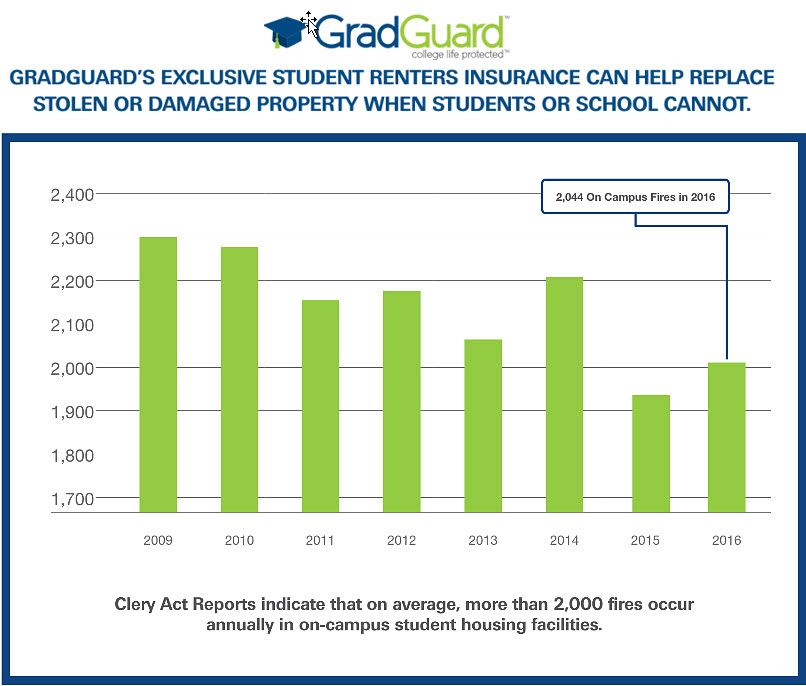

Understand the Risks of Living on Campus: For many of the nearly three-million students who live in student housing, this is the first time they are living independently and not aware that their college or university is unlikely to replace stolen or damaged student property. Clery Act campus safety reports indicate that an average of 2,000 fires are reported annually within on-campus student housing and data from the 2015 FBI Uniform Crime Reports indicate there were 69,502 property crimes reported at participating campuses. Though some parents may have coverage for their full-time students through home insurance, this coverage is often not practical as it is subject to coverage limits, high deductibles and upon filing a claim may increase the cost of your insurance. For about $.50 cents a day, GradGuard’s college renters insurance contains an exclusive student endorsement that provides world-wide property coverage, a low-deductible and no credit check, making renters insurance a must have consideration for college families.

Fees continued, “College families are often unaware that the investment they make in a college education can be at risk and many are unaware where to start to find the protection they need. As a result, an essential place to visit GradGuard.com to use our college insurance search tool to identify the insurance programs offered by your school that may contain unique coverage or pricing that can help students overcome unexpected events or financial losses that could disrupt their goal of completing college.”

About: GradGuard, is an authority in protecting the investment in higher education. By protecting students and their families from risks from college life, GradGuard helps reduce the cost of college and promote greater student success. GradGuard’s modern tuition and renters insurance programs are valuable student benefits available through a network of more than 300 colleges and universities. Since 2009, GradGuard’s insurance programs have protected more than 650,000 students and families. For more insights on #collegelife follow @GradGuard