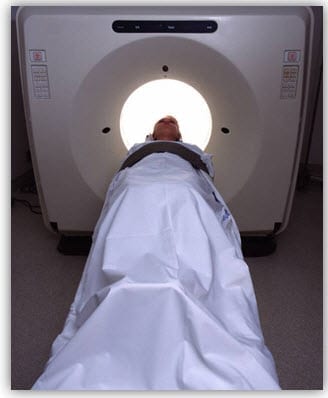

As cancer is one of the most common, degenerative, and costly medical conditions in the world today,

Many more people are realizing that their standard health insurance alone isn’t providing the complete coverage that they would require to protect their financial wellbeing in the case of a diagnosis, and are turning to supplemental options to fill that gap and ensure the healthy future of both themselves and their assets.

Though many cancers are highly treatable, and the survival rates of several forms are soaring even when compared to a decade ago, these successes rely on time off work for treatments and recovery that can be expensive on many different levels. The disease can strike regardless of age, gender, ethnic background, or any other demographic category, and all too many people are unprepared to deal with it if it should strike.

Cancer insurance can help to provide the financial support and peace of mind that is necessary when a diagnosis is made, as it fills in where standard h ealth insurance would require policyholders to make out-of-pocket payments, such as with caps, deductibles, co-pays, and others.

ealth insurance would require policyholders to make out-of-pocket payments, such as with caps, deductibles, co-pays, and others.

Some policies can also help with additional expenses that occur during a battle with cancer, as the medical costs aren’t the only financial struggle that these patients face. Since the majority of people undergoing treatments must take time off work, they no longer have an income to rely upon. That said, the bills don’t stop coming in, so many policies will help to make rent or mortgage payments, as well as those for utilities and other essentials.

California insurance agent for Allstate, Loreen Worden, recommends this type of insurance plan for all ages, “It’s not just for older people, studies show that more and more younger people are being diagnosed mainly due to hereditary cancers getting more aggressive.” She further explains that with the preventative wellness test benefits on these plans, it just makes good financial sense. “The average premium cost for California can be as low as $18 a month and if you’re getting your annual wellness test benefit back from the plan, well the out of pocket cost on this is minimal.”

This year, as Americans continue their efforts to save and protect their money, cancer insurance has topped the list as a vital element to any financial backup plan.