In a consequential ruling that will undoubtedly reverberate through insurance and telemarketing industries, Allstate Insurance has been found in violation of the Telephone Consumer Protection Act (TCPA) in a complex network of agencies and subagencies that ultimately led to unsolicited marketing calls being made to consumers. The case, titled Hossfield v. Allstate, 2024 WL 1328651, was decided on March 28, 2024, by the Northern District of Illinois court. Overview of the Judgment With an intricate chain of lead generation and marketing agencies involved, Allstate faced accusations stemming from actions unwittingly…

Read MoreAuthor: Nordstrom

New National Association of Insurance Commissioners CEO is Gary Anderson

NAIC has announced that its new chief executive officer has now been named The National Association of Insurance Commissioners recently announced that they have appointed a new CEO. The appointment went to Gary Anderson, the current Massachusetts Insurance Commissioner and veteran of the industry. Anderson will start at his new position on May 1, 2024 The start date for Anderson as CEO of the National Association of Insurance Commissioners will be May 1, giving him enough time to finish his service as the Massachusetts Insurance Commissioner. This will have him…

Read MoreMercury Insurance company awarded top spot as inclusive employer

Newsweek has named the insurer on its 2024 America’s Greatest Workplaces for Diversity list Newsweek has named the Mercury Insurance company as one of America’s Greatest Workplaces for Diversity for 2024. Newsweek and partner Plant-A Insights, a market data research firm used their own selection methodology to choose the top businesses. Several criteria were considered for the awarding of the title Before the title was awarded to Mercury Insurance company, the employers being considered were judged based on their growth opportunities, competitive salaries and other factors, when compared with other…

Read MoreNorth Carolina Commissioner rejects proposal to increase insurance rates

Drivers and property owners are reducing their coverage to afford their premiums North Carolina Commissioner Mike Causey has announced that he recently turned down a request made by insurers to boost homeowners’ insurance rates by an average of 42.2 percent. In some beach areas, the hike would have been 99.4 percent According to Causey, he was not provided with adequate evidence to support the claim insurers made that they would need to increase insurance rates by that amount. “I haven’t seen the evidence to justify such a drastic rate increase…

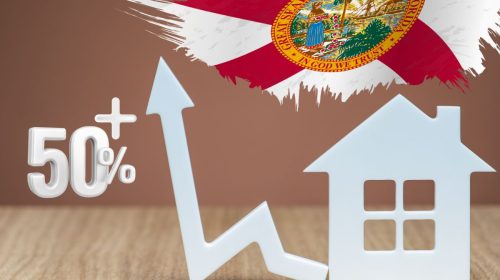

Read More2 Florida home insurance companies aim to raise rates more than 50%

Amica Mutual Insurance and Castle Key Indemnity have requested the increases in the state Home insurance rate hikes are nothing new to Florida property owners, but a recent request made by two private insurers in the state aims to increase rates by over 50 percent. Increases at that level are high even for Florida Amica Mutual Insurance and Castle Key Indemnity have formally requested to raise their rates by more than 50 percent for policies covering condominiums and secondary residences. According to the companies, the increases are required to help…

Read More