Planners and industry experts feel that additional coverage can only help newlyweds.

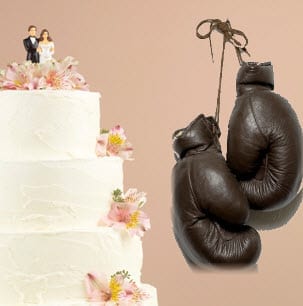

Following the increasing instances of fights breaking out at receptions, many planners and industry experts are now recommending that couples purchase wedding insurance to cover against the damage that could occur as a result of these unexpected circumstances.

The importance of coverage has become all the more clear with the high profile fights in  Philadelphia.

Philadelphia.

The massive brawl that occurred in Philadelphia and that rapidly had its video go viral, providing a clear image of how rapidly, and wildly things can go very wrong. Until this disaster, many people had not even heard of wedding insurance and didn’t know what it could provide, but it is certainly something being considered by many brides and grooms to be following that video.

Wedding insurance can protect newlywed couples against thousands of dollars in damage.

The battle that drew the country’s attention to wedding insurance occurred at the Sheraton Society Hill and broke out between two wedding parties. It not only caused massive damage, but it also led one of the guests to suffer a fatal heart attack. This disaster couldn’t have been prevented by a policy, but the debt that was left behind certainly would have.

Marriages are a celebration where many people who are celebrating behave in ways that isn’t typical. Emotions are high and alcohol is readily available. This combination of factors can easily make things go very right or very wrong. In case the latter should occur, couples can be sure that they don’t begin their wedded life with a financial catastrophe on their hands.

Planners have been recommending wedding insurance for years, to protect couples against various forms of peril that aren’t limited to fights. Some forms of coverage can be as simple as adding a one-day rider to an already existing homeowners policy in order to cover certain forms of damage and liability. Also covered by this type of policy are other risks, such as cancelled flights, and weather related cancellations, in addition to injury or illness that could cause an expensive postponement.

General liability wedding insurance costs an average of $185 for a million dollars in coverage. Many couples are now seeing what a sound investment this can truly be.