The wireless giant is now partnering with Intelligent Mechatronic Systems to appeal to auto insurers.

Sprint has now announced that it is entering into a partnership with Intelligent Mechatronic Systems, a usage based insurance technology provider that allows auto insurers to be able to offer telematics based coverage to their customers.

Traditionally, auto insurance companies use broad generalizations about various categories of drivers in order to calculate premiums. Factors can include everything from location to the age and gender of the driver, as well as figures about the vehicle that will actually be covered. This new partnership signals an important expansion of interest in the usage based insurance sector, and could propel this type of policy forward through more widespread awareness and availability.

Traditionally, auto insurance companies use broad generalizations about various categories of drivers in order to calculate premiums. Factors can include everything from location to the age and gender of the driver, as well as figures about the vehicle that will actually be covered. This new partnership signals an important expansion of interest in the usage based insurance sector, and could propel this type of policy forward through more widespread awareness and availability.

Sprint’s partnership with this Canadian firm will allow for integrated usage based insurance solutions offerings.

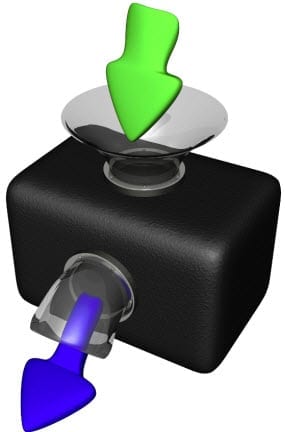

This type of coverage (also known as “pay as you drive” or shortened to UBI) requires a driver to have a small wireless device installed on his or her vehicle. This insurance technology collects data about the actual use of the vehicle, including the speeds it travels, how hard and frequently braking occurs, how rapidly it accelerates, when it is driven, and its location. This data allows insurers to have a look at the actual risk associated with covering the vehicle so that premiums will more closely reflect it.

Sprint’s partnership with Intelligent Mechatronic will allow the companies to work together using the DriveSync platform which is currently being sold by the Canadian company directly to vehicle insurers. Through this partnership, those auto insurance companies won’t be required to have to deal with several suppliers in order to be able to obtain all of the different elements of the solutions that they require in order to roll out their programs.

Instead, the new service will provide integration of usage based insurance solutions so that everything will be provided from one source, including the data collecting devices, themselves, to the methods of wireless data transmission and the analytics that are needed for report generation.