With the increasing cost of getting married and everything that it entails, more couples are purchasing coverage. The average cost for Americans to get married is now approximately $26,000 and, to an increasing degree, couples are purchasing wedding insurance to help to cover themselves against the sizeable financial losses that could occur as a result of illness, extreme weather, or even a sudden change of heart. The coverage isn’t offered by a large number of insurers in the U.S. but the number may soon grow. At the moment, wedding insurance…

Read MoreTag: Travelers Insurance

Travel insurance isn’t always practical, says National Consumers League

The group has released a statement that the protection does not always make sense. According to the National Consumers League, a group that has been in existence for 114 years, the way that the industry functions has designed travel insurance in a way that it is typically not a good deal for travelers. They have pointed out that there are far too many exceptions to make the coverage worthwhile for most people. The consumer group has pointed out that travel insurance policies are filled with different kinds of exceptions that…

Read MoreInsurance industry in N.A. sees Canadian insurer sold to American company

Travelers has announced that it will be making the purchase for $1.25 billion in cash. The North American insurance industry has seen another major acquisition as an American insurer, Travelers Companies Inc. has just revealed that it is making a purchase of the Dominion of Canada General Insurance Co. This purchase is being made for a total investment of $1.125 billion to buy the company outright. The acquisition is being made as a part of the attempt Travelers would like to make to expand its presence in the Canadian insurance…

Read MoreTravel insurance purchased by only half of Canadians

A new study has shown that only about fifty percent of travelers from the country buy a policy. A new study conducted by BMO has just revealed that while 83 percent of Canadians plan to go away on vacation at some point between May and October 2013, only half have intentions to purchase travel insurance to cover them while they are not at home. The survey examined a number of different habits of Canadians while they are away from home. For example, the average Canadian traveler intends to spend $3,073…

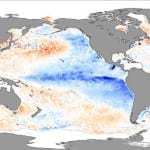

Read MoreHomeowners insurance rate increases blamed on climate change

The CEO of Travelers has said that severe weather patterns are the reason prices are rising. According to Jay Fishman, the CEO and chairman for The Travelers Cos. – one of the largest insurance companies in the country – has stated that the reason that the premiums for homeowners insurance have been steadily rising over the last three years has to do with the more extreme weather patterns that are the result of climate change. Insurers have come to accept that the weather is different now than it had once…

Read More