City is working to address the lack of insurance coverage among consumers Consumers in San Francisco, California, are finding it difficult to afford their health insurance coverage. The city is notorious for its high cost of living, which has lead many people to forgo acquiring insurance coverage. They are also avoiding seeking medical care or taking advantage of free services that are intended for the poor. Notably, a significant portion of these consumers are eligible for subsidies from the federal government that help cut down the cost of health insurance…

Read MoreTag: san francisco

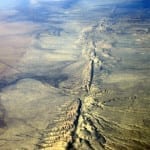

Lack of earthquake insurance could cause problems for the Bay Area

RMS report highlights dangers for the property insurance sector in the San Francisco region The San Francisco region may be struck by a powerful earthquake in the coming years, and the potential damage such a disaster could cause may not be covered by insurance. RMS, a risk management firm serving the insurance and reinsurance industries, has released a new report that highlights the impact that earthquakes may have on the insurance sector. In California, earthquake insurance is becoming increasingly rare, as consumers and businesses alike begin seeing this type of…

Read MoreFlood insurance rates spike in California

California homeowners may soon contend with higher flood insurance premiums A sudden increase of flood insurance rates in the U.S. may soon force people from their homes. Rising flood insurance costs have become quite common in states like Florida and Louisiana, both of which experience a high degree of exposure to natural disasters. Homeowners in the San Francisco Bay Area may be feeling a great deal of financial pressure from the latest hike in flood insurance rates, however. For many, this coverage may soon become too costly to manage. Rates…

Read More