This trend has been heaviest in China, where social media has reported infidelities among some top stars. As news of major celebrity divorces, infidelities, and other relationship-ending occurrences started making its rounds throughout social media sites in China, recently, the number of people who have been looking into marriage insurance has suddenly started to rise. It looks as though many people are starting to take this relationship news personally and want to protect themselves. Among the largest reports that have caused marriage insurance to increase in popularity was that Wen…

Read MoreTag: marriage insurance

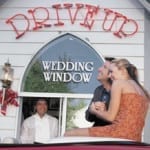

Wedding insurance can protect Valentine’s Day marriages

These policies are beginning to become big sellers, particularly around this time of year. Although wedding insurance has never been one of the top selling policies – particularly compared to the standards such as home, health, life and auto – this business is picking up quite dramatically, and experiences certain popular seasons such as around Valentine’s Day and during the summer months when the most marriages take place. These marriage insurance policies help to protect the investment of the day itself against many perils. The importance of this coverage is…

Read MoreWedding insurance becoming more common among Americans

With the increasing cost of getting married and everything that it entails, more couples are purchasing coverage. The average cost for Americans to get married is now approximately $26,000 and, to an increasing degree, couples are purchasing wedding insurance to help to cover themselves against the sizeable financial losses that could occur as a result of illness, extreme weather, or even a sudden change of heart. The coverage isn’t offered by a large number of insurers in the U.S. but the number may soon grow. At the moment, wedding insurance…

Read MoreForms of insurance coverage not always considered by consumers

Though consumers are typically aware that they need homeowners’, renters’, and automobile insurance, there are other forms of coverage that can be offered by policies of which they may be entirely unaware unless they are highly knowledgeable about the various types of protection available. Some of them include: • Personal Electronic Equipment Insurance – this is a very practical insurance for consumers who have expensive electronic devices at home, such as televisions, audio equipment, or computers. It covers loss and damage and might even pay for repairs and replacement, depending…

Read MoreCICI Lombard and Bajaj Allianz announce new wedding insurance products

CICI Lombard and Bajaj Alliance insurance companies from India have announced that they are now offering a unique form of “wedding insurance” product. Though marriages are meant to be a dream come to reality, the truth of the matter is that they don’t all come to pass, and that there is a chance that they may need be stopped for any number of reasons. The insurers recognized this fact as an opportunity and developed a new product in which weddings could be insured against the possibility of postponement or cancellation…

Read More