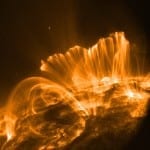

Insurance industry may not be suited for powerful solar storms Lloyd’s of London has released a new report concerning the emerging risks associated with powerful solar storms. A solar storm is produced by solar flares and coronal mass ejections that are directed in the general location of the planet. Typically, such events present no significant threat to the world as they are relatively rare and not directly targeted at earth. According to Lloyd’s, however, a direct hit from such an event could have cataclysmic consequences, especially for the insurance industry.…

Read MoreTag: Lloyd’s of London

Texas Windstorm Insurance Association may find new allies

Texas Windstorm Insurance Association attracting global attention The Texas Windstorm Insurance Association, a state-run insurance group that provide coverage for wind damage primarily to properties in coastal areas of the state, has been experiencing financial troubles recently. Financial challenges are nothing new to state-run insurance groups, as many of them offer coverage that is much more affordable than that offered by private insurance companies. Texas Insurance Commissioner Eleanor Kitzman, who is in charge of the state-run insurance group, has been traveling around the world in order to address the issues…

Read MoreInsurance industry warning released by Lloyd’s of London

The oldest market of insurers in the world has issued a caution to the globe. Lloyd’s of London, the oldest coverage market worldwide, has issued a warning to the insurance industry, cautioning it that if a natural disaster should strike in emerging economies, the cost of rebuilding could be enormous. It has included over a dozen emerging economies in its warning against tremendous rebuilding bills. In fact, it pointed out that there is currently a global insurance industry deficit worth £104 million ($168 million), and that this is now affecting…

Read MoreInsurance news from Lloyds shows that mis-sold loan policies will cost $1.6 billion more

The scandal will now have cost the company approximately £5.3 billion. Lloyds Banking Group has just released their latest insurance news statement regarding the mis-sold loan policy compensation, which now involves an additional $1.6 billion (£1 billion), bringing the total amount of these payouts up to £5.3 billion, which has yanked its numbers downwards to result in a third quarter loss. However, the largest retail bank in the U.K. is still optimistic and is encouraging customers to remain that way. Lloyds has released a positive message regarding the decreasing losses…

Read MoreThai floods: One year later

Lloyd’s of London analysts examine impact of Thai floods Just over a year ago, severe flooding in Thailand caused by a powerful and unforgiving monsoon season caused havoc in Bangkok and other cities throughout the country. Analysts from Lloyd’s of London have come together to examine the effects that the Thai floods had on the insurance industry and the country. The floods produced some $45.7 billion in damages, $12 billion of which was shouldered by insurance and reinsurance companies that operate in the country. Lloyd’s of London itself accounted for…

Read More