The site may recommend the additional protection that a policy can provide, but it also provides additional resources. A cancer insurance specialty website called CancerInsuranceInfo.com has just re-launched with a new design and direction that is geared toward assisting individuals not only in obtaining the coverage that they need, but also in improving the way that they live their lives to stay healthier and make a bigger difference to those who already have the disease. The website shows that while coverage gives peace of mind, the true goal is to…

Read MoreTag: critical illness insurance

Long term care insurance is often misunderstood, leading to poor choices

Consumers make the right policy purchasing decisions when they understand the coverage. Misunderstandings regarding long term care insurance are widespread and growing and are currently causing consumers to make choices that aren’t in their best interest in terms of the financial protection needs of themselves and their families. The biggest mistake made is that people wait too long to purchase their coverage. The best time to look into purchasing long term care insurance is before a physical or mental condition has been diagnosed, which will lead you to require assistance…

Read MoreLife insurance sales increase alongside growth in critical illness sector

The rapid growth in one has renewed interest that had been fading in the other. The current explosive growth of critical illness policies is creating a renewal in the interest that consumers have for permanent life insurance. Though the reasons for this are multidimensional, they also make a great deal of sense. Even though these products don’t appear to have much to do with one another, they are linked by certain events and circumstances that can make them both appealing to consumers at the same time. For example, as employers…

Read More2012 Critical Illness Buyer and Claimant Study results reveal latest data

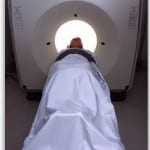

Recent research shows that the most common cause of claims are related to cancer. According to a study performed by the American Association for Critical Illness Insurance, in conjunction with General Re Life Corporation, more than half of all first-time claims filed through critical insurance policies by Americans are related to cancer. Furthermore, strokes and heart attacks made up 29 percent of the new claims last year. There are currently approximately one million people in the United States who have an active critical illness insurance policy, which functions as a…

Read MoreDisability insurance is among the most underestimated forms of protection

This coverage, as well as critical illness insurance provide greater benefits than people realize. One of the most overlooked and misunderstood forms of coverage that is currently available in the industry is disability insurance. The topic of being too sick or injured to work is an uncomfortable one for many people, and is one that they would prefer to pretend will not happen than to take the time to create a preparedness plan. However, all too many people are finding themselves in a situation where they could have used this…

Read More