The state has threatened to penalize insurers for tactics to stall in providing coverage to drivers. California drivers have been registering complaints regarding the challenge they face in trying to obtain the auto insurance legally required to drive in the state. In response, the state commissioner is warning of a potential crackdown against stalling insurers. Commissioner Ricardo Lara announced this week that his department has been receiving “numerous” complaints from auto insurance customers that are dealing with lengthy questionnaires, waiting periods and other stalling practices that are potentially violating Californian…

Read MoreTag: California Insurance Commissioner Ricardo Lara

Insurance companies must boost wildfire preparedness, says California commissioner

Ricardo Lara has called on property insurers to play a role in assisting homes and businesses in readiness. California Insurance Commissioner Ricardo Lara has called for property insurers across the state to play a larger role in boosting wildfire preparedness among homeowners and businesses. The goal is to create improved widespread readiness as the fire risk season approaches this year. At the end of last week, Lara gave an update on the actions that California communities are taking to help promote wildfire preparedness among state residents. He spoke during a…

Read MoreAfter California Department of Insurance investigation Libre must face $5.5M settlement

The company will also bring to an end its transaction of immigration bonds within the state. Following an investigation by the California Department of Insurance, Libre will be facing a $5.5 million settlement, will stop transacting immigration bonds within the state, phase out its GPS ankle monitor use, and will issue credits to the clients who remain in arrears. The firm must also provide $420 in individual cash credits to clients who are not in an owing position. Beyond that, the settlement resulting from the California Department of Insurance (CDI)…

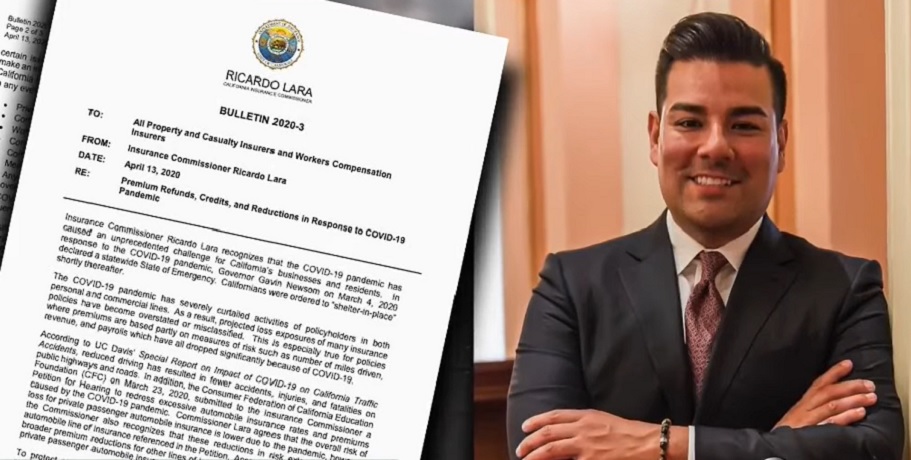

Read MoreCalifornia Insurance Commissioner orders premiums returned to businesses

Ricardo Lara has told insurers to return premiums on six lines of personal and commercial coverage. California Insurance Commissioner Ricardo Lara has ordered insurers to return premiums from certain lines to businesses and consumers. This has raised pressure on those insurers to take larger steps to reduce customer financial burden caused by COVID-19. Lara has ordered insurers to return premiums paid for March, April, and possibly May as well. The California Insurance Commissioner’s order applies to six different coverage lines. These include passenger and commercial auto, commercial multi-peril, workers compensation,…

Read MoreFossil fuel underwriting disclosure petition rejected by commissioner on Earth Day

California Insurance Commissioner Ricardo Lara has turned down the recent move by activists. Activists may have thought that they had Earth Day on their side when California Insurance Commissioner Ricardo Lara considered the fossil fuel underwriting disclosure petition. However, Lara rejected the petition urging him to implement the new regulations over insurance companies. Commissioner Lara underscored climate change as a top priority as a part of his election platform. The petition would have required insurance companies into fossil fuel underwriting disclosure. That is, they would need to disclose the fossil…

Read More