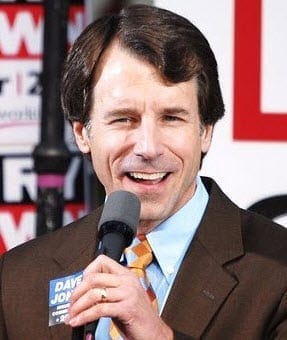

Rating agency Standard & Poor’s seems to be in the grips of a downgrading frenzy as the agency downgrades the credit ratings of five of California largest insurance companies. The move comes on the heels of the agency’s downgrading of the federal government’s credit rating, which sparked controversy throughout the country and drove many businesses to re-evaluate their place in the commercial market. S&P downgrade of the state’s insurers could have major implications for the industry, but Insurance Commissioner Dave Jones says that there should be no doubt about the strength of the affected insurers.

Rating agency Standard & Poor’s seems to be in the grips of a downgrading frenzy as the agency downgrades the credit ratings of five of California largest insurance companies. The move comes on the heels of the agency’s downgrading of the federal government’s credit rating, which sparked controversy throughout the country and drove many businesses to re-evaluate their place in the commercial market. S&P downgrade of the state’s insurers could have major implications for the industry, but Insurance Commissioner Dave Jones says that there should be no doubt about the strength of the affected insurers.

S&P’s own regulations state that no insurance company which holds a significant amount of investments in U.S. securities can have a higher credit rating than the government. Jones has been quick to reiterate this point to consumers who have grown concerned over the possible consequences following the downgrade. Jones has joined a growing crowd of insurance regulators throughout the country trying to stem the fears of consumers.

According to the LA Times, S&P released a statement following their spree of downgrades noting that the insurance companies affected are “very strong financially.” Jones noted that each company is still competitive in their particular markets and believes that S&P’s downgrade will have little bearing on how these companies do business.

The companies in question are Knights of Columbus, New York Life, Northwestern Mutual, Teachers Insurance & Annuity Association of America and the United Services Automobile Association.