Lawmakers are taking steps to fight fraud in the insurance sector

Lawmakers in Minnesota are beginning to focus on ways to cut down on insurance fraud. According to state officials, many people come to the state in order to exploit loopholes that exist in current laws, hoping for financial gain on fake medical claims and targeting other insurance sectors. Lawmakers are now drafting legislation that would provide the state’s Commerce Department with an anti-fraud unit, which would work to combat insurance fraud in Minnesota.

New anti-fraud unit will help combat fraud alongside the Commerce Department

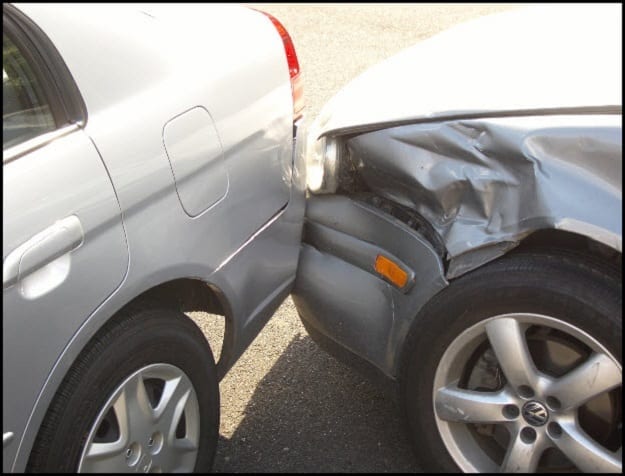

The new anti-fraud unit will be able to institute grievous fines on those that are found guilty of committing insurance fraud. The unit will have a broad focus, but will be targeting fraud where it has become most prevalent: The auto insurance sector. This sector has become particularly attractive for those committing fraud because of the laws that exist in some states. These “no-fault” laws, as they are called, require insurance companies to pay claims regardless of who may be at fault of a car accident.

Legislation is gaining support for the insurance industry

The new legislation being drafted by lawmakers has received strong support from the insurance industry and law enforcement. Insurers suggest that this will be a major step in the right direction when it comes to fighting insurance fraud. Previously, state lawmakers had sought to restrict the medical benefits that can be received for soft tissue injuries, such as sprains, as a way to detract from the attractive nature of insurance fraud. Some of the state’s efforts have been lackluster, as competing laws have served to created legal loopholes that can be exploited.

The new legislation being drafted by lawmakers has received strong support from the insurance industry and law enforcement. Insurers suggest that this will be a major step in the right direction when it comes to fighting insurance fraud. Previously, state lawmakers had sought to restrict the medical benefits that can be received for soft tissue injuries, such as sprains, as a way to detract from the attractive nature of insurance fraud. Some of the state’s efforts have been lackluster, as competing laws have served to created legal loopholes that can be exploited.

No-fault laws foster the growth of insurance fraud

Minnesota is one of nine states that have no-fault insurance laws in place. State law ensures that insured drivers will receive as much as $20,000 in medical benefits whether or not they caused a car accident. In other states, drivers that are at fault of an accident are not offered benefits. No-fault laws have been criticized by the insurance industry because of the fact that they have helped promote insurance fraud.