Property/casualty insurance companies recorded only modest loss increases in Q4 2020.

According to Fitch Ratings, insured pandemic losses in the property/casualty sector rose only slightly in last year’s fourth quarter. That said, the final tally has yet to be calculated and, according to the US credit rating agency, it will be several years before it can be.

Litigation is holding up the tally for business interruption, general and professional liability, and others.

P/C insurers have managed to widely keep up capital strength since the pandemic started, said Fitch. Equally, pandemic-related adverse rating actions have been quite limited. That said, the full value of the insured pandemic losses has yet to be seen and great uncertainty remains regarding that total.

The P/C sector outlook in the US is improving, according to Fitch. Moreover, performance this year is expected to benefit from considerable commercial line premium rate increases. Insured pandemic losses are also expected to drop, including the massive storm-related catastrophic losses recorded in Q1 2020.

Still, uncertainty remains when it comes to insured pandemic losses for any specific insurance company.

The individual risk of large losses or adverse reserve development as a result of vague or unique coverage terms remains due to the potential for adverse litigation outcomes.

Last year, over $9 billion in losses related to the COVID-19 crisis were reported by a group of 50 publicly traded insurance companies in North America. When taking major global insurers and reinsurers, as well as Lloyd’s of London, into consideration, the tally rises to $30 billion. A substantial chunk of that total has to do with travel claims that have been paid. Fitch added that most losses are still carried as incurred but have not yet been reported by insurance providers.

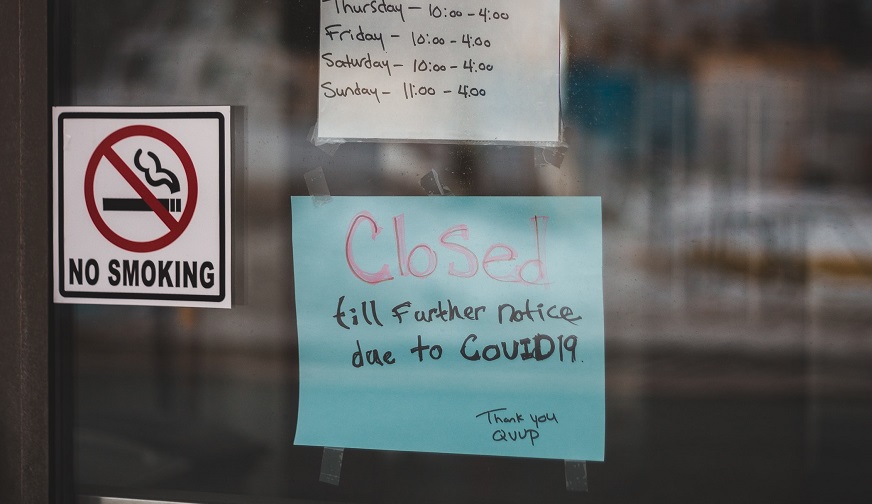

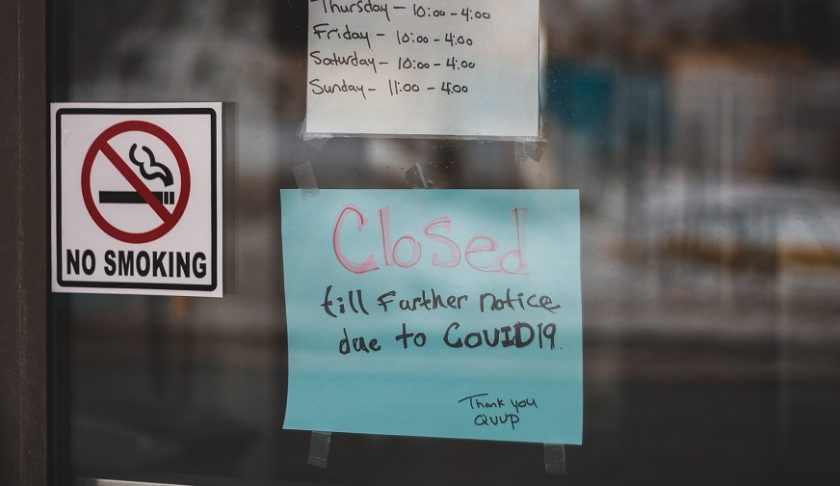

Last year’s lockdowns brought on thousands of business insurance claims. Outcomes of these claims remain widely tied up in litigation at the moment as insurers assert  that valid insured pandemic losses in the form of a business interruption claim require physical property damage. To date, these assertions have been broadly held in court rulings, especially in policies expressed using traditional terms and wording and that have specific inclusions for viruses.

that valid insured pandemic losses in the form of a business interruption claim require physical property damage. To date, these assertions have been broadly held in court rulings, especially in policies expressed using traditional terms and wording and that have specific inclusions for viruses.