Jerry B. Gol dman, the celebrity’s insurance broker, has been charged with fraud.

dman, the celebrity’s insurance broker, has been charged with fraud.

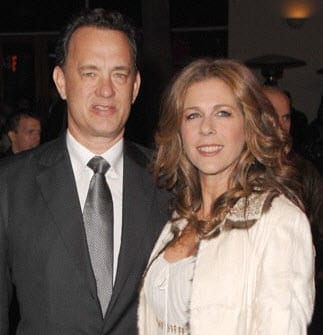

Tom Hanks is making insurance news, but not because of a blockbuster movie. Instead, it is because he, a former guitarist from The Police, Andy Summers, and hundreds of others have been overcharged by their broker, who has been charged with fraud.

The Southern Californian broker pled not guilty to the allegations against him on Wednesday.

The broker who has been charged with fraud is named Jerry B. Goldman. He was arrested from his home in Thousand Oaks, California, but has since been released from federal custody when his wife posted a bond of $25,000. This, according to the executive assistant U.S. attorney, Stephanie Yonekura-McCaffrey.

Goldman made insurance news when he was indicted in Los Angeles by a federal grand jury on October 30.

The indictment claims that are making insurance news span a massive length of time, from 1998 through 2011. They involve the overcharging of Goldman’s clients – such as Hanks and Summers – for a total of over $800,000 on their policies.

According to the prosecutors in the insurance news against Goldman, he was overcharging those customers, sending the actual premiums to the insurers, and then keeping the additional amounts for himself. When the customers asked to receive copies of their policies, Goldman allegedly sent altered copies of the documents, which did not reveal the actual premiums that were being paid to the insurers.

The indictment charges in the case said that the premiums were not revealed “in order to lull his clients into a false sense of security,” as well as to prevent them from suing him or pursuing criminal prosecutions.

Further insurance news details have not yet been released, but the indictment itself states that the term “insurance policies” within the document makes reference to the coverage of everything from property to vehicles and fine art, against perils such as fire, flood, earthquakes, and even workers’ compensation and “personal employment practices liability”.

More insurance news will certainly come as the trial date for the case approaches on December 18, 2012, as well as when it actually gets under way.