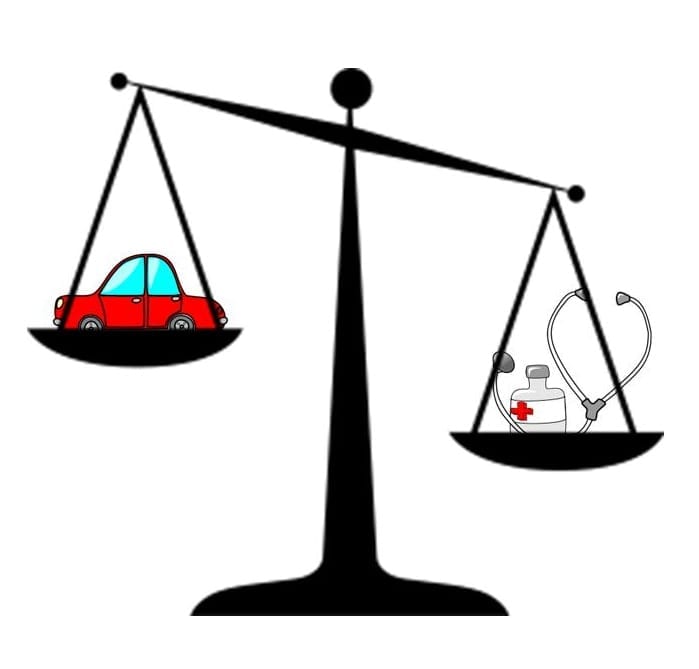

Some American insurers intend to treat medical coverage similarly to auto policies.

Some American insurers intend to treat medical coverage similarly to auto policies.

There have been many new developments in the health insurance sector over the last few months as companies prepare to manage the influx of new policyholders and to comply with the laws and regulations that have been put in place as a result of the federal healthcare overhaul.

As a part of this change, some insurers have been changing their strategies to reflect vehicle coverage.

Vehicle policies reward drivers who display good behaviors which would decrease their risk of having to make a claim. For example, motorists who have not been involved in accidents and whose records are free of speeding tickets have cheaper premiums than those who have red marks on their driving history.

Until now, health insurance companies have done little to reward patients who lower their medical risks.

An increasing number of healthcare advocates feel that failing to provide an incentive for health insurance customers to reduce their likelihood of illness or injury is unwise, and that it would be much more practical to implement a system that would think of medical and driving safety in a similar way.

Though some plans have been put into place for lowering the cost of care through healthier behaviors, most of those programs have been designed to generate savings for employers and health insurance companies, but not for employees and individuals who typically pay the same amount in their premiums and co-pays no matter what healthy lifestyle they live.

While it is still small, a growing number of businesses are starting to tinker with health insurance models that would allow those workers who don’t make claims to keep some of that money that wasn’t spent. In this sense, they reward or penalize employees based on their wellness management.

Many of those programs are comparable to auto coverage, as the employees who take the most steps to be safer and healthier pay less than those who live lifestyles that place them at a higher risk of developing diseases (such as in the case of smoking or obesity). Though this may not provide immediate advantages, over time, it can help people to gain some control over the cost of their health insurance.