Are your golden years protected against the cost of illness and injury?

Though disability insurance is considered one of the key elements of any sound retirement plan, all too many Americans are finding themselves without this vital financial protection, even if they diligently max out their IRA and 401(k) every year.

Individuals and financial planners alike are overlooking the need to discuss this topic.

Though many concentrate hard on the risk of remaining employed due to economic circumstances, many are neglecting to remember that there are other reasons that an individual’s ability to earn could be restricted, and that these are just as threatening to a retirement plan as layoffs or a poorly performing stock portfolio.

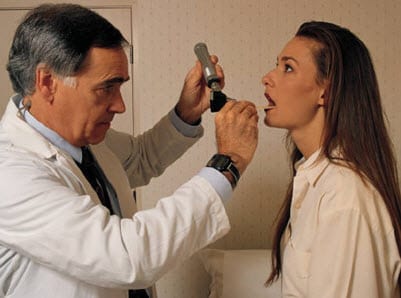

Illness or injury could easily lead to missed months or years of income.

Even two years in which income has been cut off can derail an entire plan for retirement savings. Not only would you no longer be able to put money away, but it is also likely that you will need to dip into the funds you had already designated for retirement, as you will need some source of cash to cover your monthly expenses. Furthermore, those costs every month may be notably higher if there are medical products and services to be covered. Deductibles, co-payments, caps, and limitations can all lead to soaring medical expenses on top of your rent, mortgage, utilities, and food bills.

It is important to speak with a professional regarding this vulnerability to help you to determine whether or not disability insurance is worth your while, and if it will help you to keep your retirement safe.

The findings of a recent Consumer Federation of America survey, performed with Unum, an employee benefits provider, have shown that contrary to common belief, freak accidents are nowhere near the leading cause of disability insurance claims. Instead, a full 90 percent of them involve common health conditions and illnesses, for example, cancer or back problems. A professional should recommend that you not be too lax about your ability to weather an illness or injury over the long term without impacting your savings. Your retirement could depend on it.