As insurance companies from around the nation begin to crack down on fraud, some are finding themselves accused of the very thing they are trying to expunge. Such is the case with Metropolitan Life Insurance Co. The insurer is accused by the state of California of not paying life insurance benefits after finding out that the policyholder had passed away.

As insurance companies from around the nation begin to crack down on fraud, some are finding themselves accused of the very thing they are trying to expunge. Such is the case with Metropolitan Life Insurance Co. The insurer is accused by the state of California of not paying life insurance benefits after finding out that the policyholder had passed away.

The state is getting ready to investigate the practices of the company in an effort to determine whether these allegations are true or false.

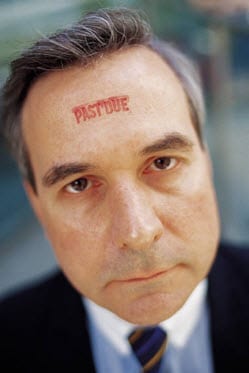

Earlier this week, Insurance Commissioner Dave Jones, along with State Controller John Chiang, issued a subpoena and has ordered a hearing regarding the New York based insurer. The two are backed by an audit conducted in 2008 which found the insurer had failed to pay benefits for nearly 20 years. The report found that, even when MetLife knew the policyholder had passed away, they refused to pay benefits to beneficiaries. Instead, they continued to make premium payments from the account until there was no money left, at which point they would cancel the policy.

The state of California has dealt with this sort of thing in the past. Both John Hancock and National Western Life Insurance Co., agreed to settle after the state had found them guilty of unfair practices. Whether Jones and Chiang will seek a settlement agreement with MetLife remains to be seen, but the company is likely to pursue that course of action.