Are you a young or relatively inexperienced driver who is tired of paying astronomical auto insurance rates? A solution to these staggering fees may be coming to a broker near you. And it comes in the form of a little black box.

Yes, the technology that solves airline crash mysteries is becoming available to passenger cars. Perhaps, even the one in your driveway.

Usage-based Insurance

Just north of the border, Desjardins Insurance has began offering its clients in Ontario and Quebec “usage-based” insurance. This option is meant to allow high-risk drivers to demonstrate their safe driving practices in exchange for a discount of up to 25 percent. Desjardins spokesman, Joe Daly, states that approximately a third of the company’s new clientele opt for this type of policy.

The Little Black Box

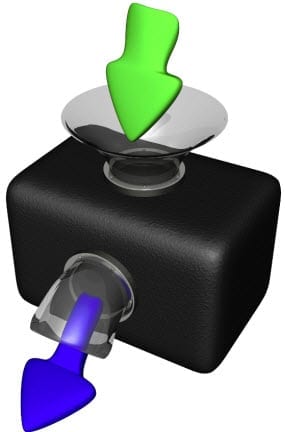

So, how do you prove that you are, in fact, a safe driver? Simple. Desjardins Insurance installs a free “black box” into your car and the data collection begins. The little black box, also known as a telematics device, immediately begins transmitting information such as how quickly you accelerate, how hard you brake, how smoothly you take corners, the amount of time spent driving, and the time of day.

All of these factors are used to determine just how safely and conscientiously you drive–which will, in turn, be used to establish a suitable insurance rate. Not bad for a box that is no bigger than a deck of cards.

Privacy Concerns

Desjardins’ “usage-based” policy is merely an option for clients who choose to participate. Plus the  company promises that its clients’ personal data will not be shared with any third parties. In fact, the Ontario Privacy Commissioner was impressed with the privacy protection measures utilized by the insurer. This, however, has in no way alleviated the concerns of many of this policy’s detractors.

company promises that its clients’ personal data will not be shared with any third parties. In fact, the Ontario Privacy Commissioner was impressed with the privacy protection measures utilized by the insurer. This, however, has in no way alleviated the concerns of many of this policy’s detractors.

One of the major concerns held by many is that the data collected could be used against drivers down the road. If, for instance, the police come knocking on the insurance company’s door bearing a warrant, they will gain access to a client’s data.

Lawyers, hypothetically, may be able to secure this data. They would then have access to the complete driving history of that individual including not just their driving style, but also their destinations and times of travel.

Another concern is that the information may be sold to another party. Bringing up issues like how long is the data stored for as well as security issues of outside vendors that actually store the data.

Other proponents of “Black Box Insurance” worry that this optional program could lead to the mandatory installment of telematics devices in all vehicles. Current “usage based” policies could be perceived as being a testing ground and if proved successful, a much broader push could begin.

If you are sick of nightmarish insurance premiums and confidant that your driving skills are discount-worthy, a “Black Box Insurance” policy may be perfect for you. But if you are leery of Big Brother and your personal privacy, your exorbitant rates may be well worth the price. Either way, the little black box will likely be available in your neighborhood in the not-too-distant future–whether you deem it a friend or foe.

What are your thoughts on “Black Box Insurance?”

Kimberley Laws is a freelance writer and avid blogger. She has written on a wide assortment of topics including social media marketing, luxury travel, and small business reputation management. You can follow her at kimberleylaws.com.

Please Note: Articles posted by guest writers are monitored but in no way do they reflect the opinion nor is this publication affiliated in any way with the subject or promotion of a subject. Any advice given should be consulted with your insurance agent first.