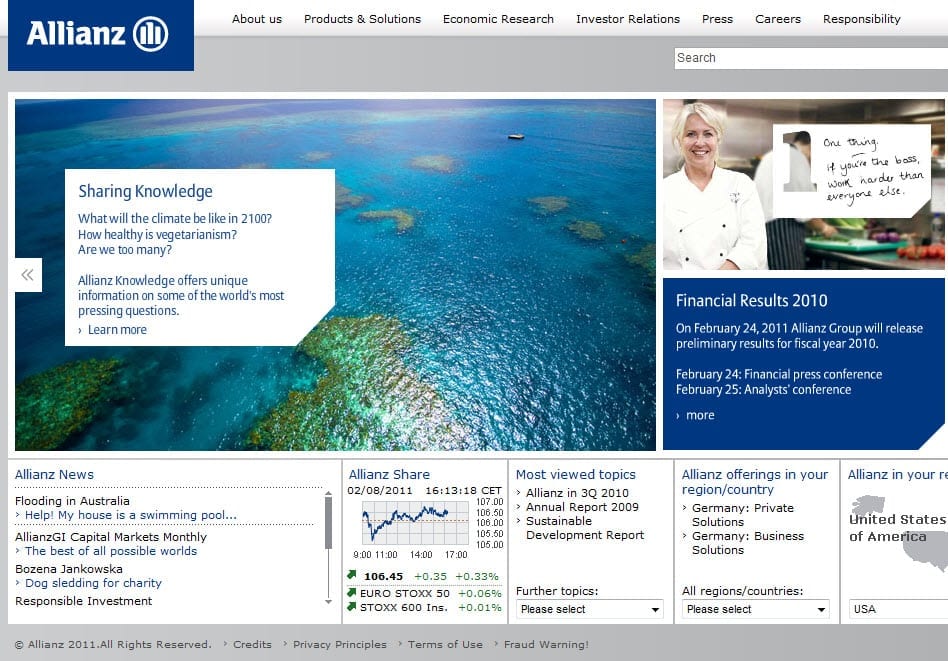

Risk assessment experts at Allianz, one of the largest insurers in the world, have spoken out about the rising costs insurers are experiencing from natural catastrophe, outlining their findings in risk briefing – Allianz Risk Pulse: Focus Natural Catastrophes. With occurrences of severe weather, earthquakes and flooding, many insurance companies are seeing losses due to natural disasters and, according to Allianz, the number of companies experiencing these losses is on the rise. However, the increase may not be due to natural disasters at all.

Risk assessment experts at Allianz, one of the largest insurers in the world, have spoken out about the rising costs insurers are experiencing from natural catastrophe, outlining their findings in risk briefing – Allianz Risk Pulse: Focus Natural Catastrophes. With occurrences of severe weather, earthquakes and flooding, many insurance companies are seeing losses due to natural disasters and, according to Allianz, the number of companies experiencing these losses is on the rise. However, the increase may not be due to natural disasters at all.

Allianz finds that the growing trend of losses is spurred by economic growth rather than natural catastrophes. The company cites rising property values and population density as the key contributing factors to losses. High risk areas, such as areas prone to flooding or in close proximity to fault lines, are experiencing higher insurance penetration as well. Allianz expects the trend to continue, making note that climate change, in particular, must be “closely watched.”

Analysts stress the importance of being prepared as well. The most costly natural disasters, in terms of human casualties, have not necessarily been the fiercest. The 2010 Haitian earthquake was several magnitudes weaker than the earthquake that struck Chile only two months later. Yet Haiti was plunged into utter chaos following the quake and suffered more casualties than its counterpart in Chile.

The briefing insists that insurers take more responsibility in educating their customers on preparedness. Companies play a major role in the lives of those affected by natural disasters and can mitigate the problems of such happenings through helping their customers better analyze risk.