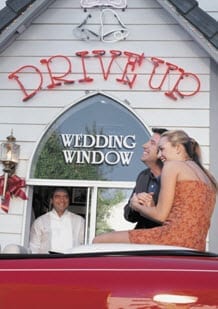

Wedding insurance: buy it or drive thru…

It isn’t common to hear about wedding-related claims in headline insurance news, but the fact is that there are a growing number of claims being made by future brides and grooms as well as newlyweds.

It isn’t common to hear about wedding-related claims in headline insurance news, but the fact is that there are a growing number of claims being made by future brides and grooms as well as newlyweds.

Couples have a great deal to worry about and there are a number of risks that apply to the day that is likely to be the most expensive celebration that they will throw in their lifetimes. Travelers is among the insurers that are now offering a Wedding Protector Plan, and it has released the results of an analysis of the most common reasons that policyholders made claims relating to their weddings last year.

The largest percentage of wedding insurance claims were made as a result of “vendor- and venue-related” issues, at 31 percent of all of the claims made on these policies. These included problems such as vendors or facilities going out of business, photographs or flowers that went undelivered, or missed appointments by D.J.’s

Among the other claims that were filed included the following:

• 19 percent of claims were due to illness, injury, and mishaps

• 17 percent of claims came from unavoidable wedding cancellations, military duty/deployment, or mistakes regarding wedding attire

• 13 percent of claims resulted from theft or vandalism

• 10 percent of claims occurred following problems from catastrophic weather conditions

According to a statement released by the vice president for Wedding Insurance at Travelers, Chantal Cyr, “Couples should seriously consider the financial risks associated with planning a wedding and protect their investment and budget accordingly.” The insurer has also broadened its policies for special events to include anniversaries, birthdays, bar mitzvahs, bat mitzvahs, and other important celebrations and occasions.

Aside from Travelers, a number of other specialty insurers are also offering wedding insurance coverage, including Event Insurance Now, Wedsure, and Wedsafe. Furthermore, Fireman’s Fund is also offering coverage for special events which can include weddings and the receptions that follow.

With this wedding insurance news, it was also indicated that the cost of a basic policy for coverage of the event as well as attire, rings, gifts, photos, video, and deposits will depend on the amount of coverage that is wanted, but it will typically range from $155 to $550.

Article:Wedding insurance: the most common types of claims

Article Source: Live Insurance News

Author: Colleen Jeremy

Wedding insurance: the most common types of claims